In today’s fast-paced business world, efficiency and security are paramount when it comes to managing financial transactions. QuickBooks checks offer a reliable and convenient solution for businesses to streamline their payment processes while ensuring the utmost security. In this article, we will explore the benefits and features of Deluxe QuickBooks checks and how they can enhance the financial management of businesses large and small.

What are Deluxe QuickBooks Checks?

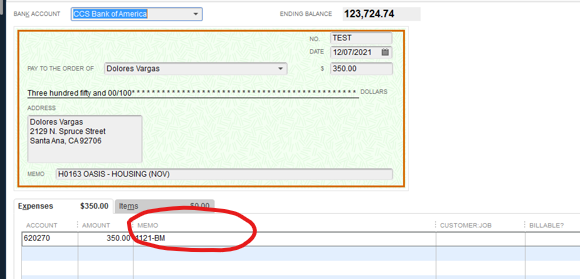

Deluxe QuickBooks checks are personalized checks that businesses can use for their financial transactions. They are designed to work seamlessly with QuickBooks accounting software, offering a streamlined and efficient payment management system.

The Advantages of Using Deluxe QuickBooks Checks

These QuickBooks checks come with a range of advantages that benefit businesses of all sizes:

- Customization and Branding Options

One of the standout features of QuickBooks checks is the ability to personalize and brand them according to the business’s identity. Companies can incorporate their logo, colors, and even personalized messages onto the checks. This level of customization not only enhances brand visibility but also adds a professional touch to every financial transaction. When clients and vendors receive checks adorned with the company’s logo and colors, it reinforces brand recognition and leaves a lasting impression of professionalism.

- Enhanced Security Features

Deluxe QuickBooks checks are designed with advanced security features to safeguard against fraudulent activities and unauthorized alterations. These security features may include holograms, watermarks, and heat-sensitive ink. The incorporation of these elements ensures that the checks are highly resistant to counterfeiting attempts.

- Easy Integration with QuickBooks Software

One of the most significant advantages of using these QuickBooks checks is their seamless integration with QuickBooks accounting software. This integration eliminates the need for manual data entry when printing checks, reducing the risk of errors and saving valuable time in the accounting process.

- Cost-Effectiveness and Time Savings

Deluxe checks contribute to cost-effectiveness by streamlining payment processes and reducing the time spent on manual tasks. The automation of check printing and transaction recording saves valuable staff hours that can be redirected to other essential business activities.

- Multiple Check Types Available

Deluxe QB checks come in various formats, including voucher checks, standard checks, and payroll checks, catering to different business needs.

- Simplified Reconciliation

With clear and concise check stubs, Deluxe checks simplify the reconciliation process, ensuring accurate record-keeping and financial tracking.

How to Order Deluxe QuickBooks Checks?

Ordering Deluxe QuickBooks checks is a user-friendly process that can be completed in a few simple steps:

Step-by-Step Ordering Process-

- Choose Check Type: Begin by selecting the appropriate check type that aligns with the business’s requirements. Businesses can opt for voucher checks, standard checks, or payroll checks, depending on their specific needs.

- Customize Checks: Once the check type is selected, the business can proceed to customize the checks with its logo, business information, and preferred design. This step allows the company to create checks that reflect its brand identity.

- Select Quantity: Determine the number of checks needed for business operations. Ordering checks in bulk can be a cost-effective approach for businesses with regular payment requirements.

- Add Security Features: Next, businesses can enhance the security of their QuickBooks checks by adding advanced security features. These features may include holograms, watermarks, and heat-sensitive ink, providing robust protection against check fraud.

- Review and Confirm: Before finalizing the order, it is essential to thoroughly review all the details and specifications. This step ensures that the checks will be printed with accurate information and in line with the business’s requirements.

Ensuring Accuracy in Check Printing

When ordering the QuickBooks checks, accuracy is of utmost importance to ensure seamless integration with the QuickBooks software. To avoid any discrepancies in the printing process, businesses should verify all the information entered during the customization process. Key details to verify include bank account numbers, routing codes, and the correctness of the company logo and business information.

By paying attention to detail and verifying all the information, businesses can ensure that their QuickBooks checks are printed accurately and ready for use with QuickBooks software.

Using Deluxe QuickBooks Checks Effectively

To maximize the benefits of using Deluxe QuickBooks checks, businesses can follow best practices for check management and leverage the efficiency of QuickBooks integration.

Best Practices for Check Management

- Secure Storage: Storing unused checks in a secure and locked location is essential to prevent unauthorized access. Access to blank checks should be restricted to trusted personnel.

- Timely Reconciliation: Regularly reconciling the checkbook with financial records is critical for maintaining accurate financial records and detecting any discrepancies promptly.

- Prompt Printing: Printing checks as needed reduces the risk of checks being misplaced or falling into the wrong hands. Businesses should have a system in place to print checks promptly when payment is due.

Maximizing Efficiency with QuickBooks Integration

- Automate Processes: QuickBooks software offers various automation features that can streamline payment processing and record-keeping. By utilizing these features, businesses can reduce manual data entry and save time in the accounting process.

- Regular Updates: Keeping QuickBooks software up to date is essential to ensure smooth integration with these QuickBooks checks. Regular updates help ensure compatibility and access to the latest features.

Ensuring Accuracy in Check Printing

When ordering these QuickBooks checks, accuracy is crucial to ensuring seamless integration with the software. Verify all the information entered, including bank account numbers and routing codes, to avoid any discrepancies in the printing process.

FAQs

What are Deluxe QuickBooks checks?

Deluxe QuickBooks checks are customized business checks designed to work seamlessly with QuickBooks accounting software.

How can I order Deluxe QuickBooks checks?

You can order them online through Deluxe’s official website or by contacting their customer service.

Can I add my company logo to the checks?

Yes, Deluxe offers the option to add your company logo for a personalized touch.

Conclusion

Deluxe QuickBooks checks provide businesses with a powerful tool for efficient and secure financial transactions. With their customizable options, advanced security features, and seamless integration with QuickBooks software, they streamline payment processes and enhance the overall financial management of businesses. By following best practices for check management and maximizing the efficiency of QuickBooks integration, businesses can enjoy the benefits of QuickBooks checks while safeguarding their financial operations.