Mutual funds provide ‘N’ number of funds to invest. Offering the investors to choose according to their financial desire or time horizon. The criteria for selecting a fund depends on the objective, expertise of the fund manager, investment strategy, and historical performance to describe a top fund. Investors always choose low-risk investment funds because risk provides stability, but higher risks can offer a chance for better returns. It depends on the fund management team how they will handle the market volatility.

In this article, we will see how the HDFC Balanced Advantage Fund has been doing in recent years what is the objective of the fund. Who should invest in this fund, and if this fund completes your desired investment objective.

Overview of HDFC Balanced Advantage Funds?

The HDFC Balanced Advantage fund is a mutual fund scheme provided by HDFC Mutual Fund. This dynamic asset allocation fund has an impressive history. This fund was introduced to investors on January 1, 2013. The Asset Under Management (AUM) of this fund stands at INR 73,349 crore.

As an open-ended balanced advantage fund. Its primary objective is to attain long-term capital appreciation and income. The fund achieves this by strategically investing in a blend of equity and debt instruments. This dynamic asset allocation allows the fund to adapt to varying market conditions, optimizing the portfolio for the best possible performance.

Key Features of the Fund

- Dynamic Asset Allocation: In response to market and economic conditions, the fund dynamically modifies the proportion of equity and debt instruments in its portfolio.

- Long-Term Capital Appreciation: Intended to give investors the chance to profit from long-term capital growth through a combination of debt and equity investments.

- Open-Ended Structure: Since the fund has no set maturity date, investors are free to purchase or redeem units whenever they choose.

- Flexibility in Allocation: The fund provides for modifications to optimize returns and control risk about asset allocation.

- Risk Diversification: The fund seeks to strike a balance between growth potential and risk avoidance by investing in both debt and equities, hence offering diversification benefits.

- Expert Fund Management: Skilled specialists oversee the fund, allocating assets strategically after doing in-depth market research.

- Historical Performance: By taking into account the fund’s historical performance since its inception, investors may assess its performance over time.

- Possibility of Income Generation: By investing in debt instruments, the fund hopes to provide income in addition to capital appreciation.

- Liquidity: Because the plan is open-ended, investors can purchase or sell units on any business day at the current Net Asset Value (NAV).

- Adaptability to Market Conditions: The fund’s adaptability is improved by the fund manager’s latitude in modifying the portfolio in reaction to shifting market conditions.

What is the Objective of this fund?

HDFC offers an open-ended balanced advantage fund designed to achieve long-term capital appreciation and income by investing in a combination of equity and debt instruments. Various asset classes inherently possess distinct risk-return profiles, and they often display a lower correlation to each other compared to investments within the same asset class.

Different asset classes inherently possess distinct risk-return profiles, and they often display a lower correlation to each other compared to investments within the same asset class. This fund leverages the diversity of these asset classes to optimize returns while managing risk.

The asset allocation between equity and debt is not fixed; instead, it is determined by the fund manager based on prevailing market and economic conditions. This dynamic approach allows the fund to adapt to changing circumstances, ensuring an optimal mix for potential returns.

Let’s see the recent performance of HDFC Fund

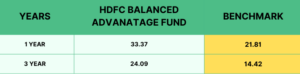

As evident from the data, HDFC has shown annualized returns of 33.37% and 21.81% for the 1-year and 3-year periods, respectively. In comparison, its benchmark recorded returns of 24.09% and 14.42% for the same respective periods. This indicates that the fund has outperformed its benchmark demonstrating its ability to deliver superior returns to investors.

Outperformance against the benchmark is a positive sign for investors. Suggesting that the fund’s investment strategy and management decisions have been successful in delivering superior results.

Various factors, including the fund manager’s expertise and strategic asset allocation decisions, attribute to this outperformance. And the overall performance of the underlying securities within the fund’s portfolio.

Who Should Invest in HDFC Balanced Advantage?

Diversified Investors: If you appreciate spreading your money across both stocks (equity) and bonds (debt), a Balanced Advantage Fund could suit you well.. It helps you benefit from different types of investments.

Long-Term Goals: If you’re thinking about your money for the long term. Like saving for retirement or a big future expense. This type of fund aims to provide both growth and some stability over time.

Comfort with Moderate Risk: While it’s not as risky as investing only in stocks, there’s still some risk involved. If you’re okay with a moderate level of risk in exchange for potential returns. This type of fund aligns with that approach.

Those Adaptable to Market Changes: Since the fund manager can adjust the mix of stocks and bonds based on market conditions. It’s good for investors who want their investments to be adaptable to changing economic situations.

Hands-off Investors: If you don’t want to worry too much about constantly managing your investments. A Balanced Advantage Fund is managed by professionals who make those decisions for you.

Conclusion

Investors who are diversified, have long-term financial objectives, and can tolerate a small amount of risk might consider this product. Its expert management and capacity to adjust to changes in the market make it a desirable option. Potential investors may want to think about using an Systematic Investment Plan. In mutual funds as a handy and methodical technique that offers flexibility and simplicity in mutual funds as a handy and methodical technique that offers flexibility and disciplined investment.