Introduction

Navigating the world of investments may be difficult, especially when it comes to understanding tax-saving solutions like the Equity Linked Savings Scheme (ELSS). However, with the potential for huge long-term returns and tax benefits, ELSS offers a one-of-a-kind opportunity for Indian investors. In this essay, we’ll go over everything you need to know about ELSS, from its fundamental qualities to the benefits it provides investors. We’ll look at the lock-in period, the advantages of investing in ELSS Mutual Fund, and whether Systematic Investment Plans (SIPs) are a good option for ELSS investments. In addition, we will present a list of some notable ELSS schemes to consider and compare to other tax-saving devices. This article will provide a full grasp of ELSS Fund schemes. Let us explore together.

Reviewing the ELSS Category

ELSS, or Equity Linked Savings Scheme, provides a unique chance for Indian investors to reduce taxes while still possibly earning considerable long-term gains. These mutual funds combine the growth potential of stock investments with the tax benefits given by Section 80C of the Income Tax Act.

One of the primary characteristics that distinguishes ELSS from other tax-saving vehicles is its investment time frame. Individuals who invest in ELSS agree to devote their cash for at least three years. While this may appear to be a long time frame to some investors, it is completely consistent with the concepts of long-term wealth growth. By remaining invested for the specified time, investors can benefit from the growth potential of the underlying equity investments in the ELSS portfolio.

Advantages of ELSS Fund Schemes

The ELSS Mutual Fund offers various advantages to its investors. Some of the following are mentioned below:

Diversification

ELSS gives investors the chance to distribute their money among a range of equities. Because of the potential decrease in the impact of a single stock’s poor performance on the whole investment, diversification helps lessen risk.

Possibility of High Returns

ELSS funds have a history of producing strong long-term returns. ELSS is a desirable alternative for anyone wishing to secure their financial future because it offers investors the chance to gradually increase their wealth.

Tax Benefits

The tax benefits that investing in ELSS provides are one of its main advantages. ELSS investments allow investors to deduct their taxable income under Section 80C of the Income Tax Act. This lowers their tax obligation and promotes wealth accumulation.

To sum up, ELSS is a desirable investment option for people who want to save money on taxes in addition to capital gains. For investors looking to reach their financial objectives while successfully managing risks. ELSS stands out as an appealing choice because of its tax advantages, potential for high returns, and diversity.

Is it good to do SIP in ELSS Funds?

It is very important to note that SIPs offer systematic plans for one’s investment journey. In the ELSS category, it gives the following benefits to the investors:

Consistent Investing

SIPs allow investors to make fixed contributions regularly, usually every month. Regardless of market swings, this stability fosters a disciplined attitude to investment.

Rupee-Cost Averaging

With SIPs, investors can purchase more units at a discount to market prices and fewer units at a premium. The rupee-cost averaging method lessens the effect of market volatility on the entire investment.

Power of Compounding

Investors can take advantage of the power of compounding by making consistent investments over time. In the long run, reinvesting capital gains and dividends from ELSS investments can greatly increase returns.

Listing some good ELSS schemes to invest in

The selection of a good fund in any category depends upon various factors such as risk levels, objectives etc. The purpose of investment plays a crucial role in selecting a particular fund. Especially in this category make sure that investments and goals align with one another. Here is a list to choose from:

Parag Parikh ELSS Tax Saver Fund

Investment objective

This scheme uses a diverse portfolio of equities and equity-related securities to produce long-term capital appreciation. (80% of total assets in line with the Ministry of Finance’s notification of the Equity Linked Saving Scheme, 2005)

Fund house name: PPFAS Mutual Fund

CAGR: 23.06%

Launch date: 05.07.2019

AUM: INR 2.997.16 Cr (as of 29.02.2024)

Benchmark: Nifty 500 TRI

Quant Tax Saver Fund

Investment objective

This scheme invests mostly in growth-oriented equity shares to produce capital appreciation. The provision of dividends and other income is the secondary goal.

Fund house name: Quant Mutual Fund

CAGR: 15.85%

Launch date: 01.04.2000

AUM: INR 7,769.92 Cr (as of 29.02.24)

Benchmark: Nifty 500 TRI

Kotak Tax Saver Fund

Investment objective

This scheme allows investors to take advantage of the income tax refund by current tax regulations and produce long-term capital appreciation via a diverse portfolio of equity and equity-related assets.

Fund house name: Kotak Mahindra Mutual Fund

CAGR: 13.33%

Launch date: 01.11.2005

AUM: INR 5,050.36 Cr (as of 29.02.24)

Benchmark: Nifty 500 TRI

DSP ELSS Tax Saver Fund

Investment objective

This scheme seeks to help investors take advantage of the deduction from total income allowed by the income tax statute. It creates medium- to long-term capital growth from a diversified portfolio primarily composed of stock and equity-related securities of corporates.

Fund house name: DSP Mutual Fund

CAGR: 15.03%

Launch date: 05.01.2007

AUM: 14,147 Cr (as of 29.02.24)

Benchmark: Nifty 500 TRI

Bandhan ELSS Tax Saver Fund

Investment objective

This plan aims to create a diverse portfolio by purchasing equities at fair prices from companies with solid fundamentals. The scheme may invest up to 20% in debt and money market instruments and 100% in stocks (including securities related to stocks).

Fund house name: Bandhan Mutual Fund

CAGR: 18.63%

Launch date: 26.12.2008

AUM: INR 6,139.72 Cr (as of 29.02.24)

Benchmark: S&P BSE 500 TRI

SBI Long-Term Equity Fund

Investment objective

After being transformed into an open-ended plan in November 1999, This scheme aims to generate capital appreciation through investments in bonds, fully convertible debentures, cumulative convertible preference shares, and stocks.

Fund house name: SBI Mutual Fund

CAGR: 12.28%

Launch date: 31.03.1993

AUM: INR 21,202.78 Cr (as of 29.02.24)

Benchmark: S&P BSE 500 TRI

HDFC ELSS Tax saver

Investment objective

With at least 80% exposure to stocks, FCDs, preference shares, and corporate bonds, the scheme aims to increase capital.

Fund house name: HDFC Mutual Fund

CAGR: 22.04%

Launch date: 05.03.1996

AUM: INR 13,820.09 Cr (as of 29.02.24)

Benchmark: Nifty 500 TRI

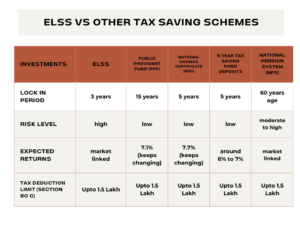

Comparisons of ELSS with other tax-saving instruments

A brief comparison of ELSS and various tax-saving options is provided below:

Conclusion

Finally, the ELSS Mutual Fund provides a unique chance for Indian investors to minimize taxes while potentially making considerable long-term gains. With its diverse investment possibilities, potential for high returns, and tax benefits under Section 80C of the Income Tax Act, ELSS is an appealing investment option. Furthermore, investors can make informed decisions that are in line with their financial goals by taking into account aspects such as the lock-in period, the benefits of SIP investments, and a variety of top-performing ELSS plans. Whether for tax savings or wealth building, ELSS is an appealing choice for individuals seeking to maximize their investment portfolios. It also offers an online Systematic Investment Plan(SIP) to give the comfort of investing from anywhere. This helps in planning one’s future goals and ensures financial stability.